- Supermarkets

- Mass Merchants

- Drug Stores

- Natural Grocers

- E-Commerce

- Military Retailers

- Farm and Feed

- Convenience Stores

- Limited Assortment Stores

- Club Stores

- Dollar Stores

- Hardware Stores

- Pet Supermarkets

Start-up and Emerging Brands

As part of our education series, our expert partners will be continue to create programs educating about both Shopper Insights and Consumer Insights.

Insights By Retail Channel (Format)

Which retail channels are the primary locations that shoppers decide to buy from. Are shoppers jumping from supermarkets to mass merchants to dollar stores to limited assortment stores to even convenience stores for their primary needs. More and more are deciding to shop with online retailers as their primary choice.

Shopper Insights vs. Consumer Insights: What’s the Difference?

By Eugenia Gomez (www.Numerator.com)

The basic difference between Shopper Insights and Consumer Insights teams is the focus of their research: the person making the purchase decision (the “shopper”) vs. the person using the product (the “consumer”). Spoiler alert: the buyer and consumer of dog food are different people (er…species). Of course, the distinction between the shopper and consumer is not always this clear, especially when it comes to “personal” categories. Without the right data sets and survey capabilities, it’s difficult for a brand to know if a shopper is also the end user when they buy things like cereal, a toothbrush, or beer, for example. Understanding the distinction between the shopper vs. consumer— and their respective attitudes and behaviors— is imperative for a brand to effectively market its products.

While these Shopper and Consumer teams may leverage the same data sources (panel, point-of-sale, loyalty, survey, etc), they have different goals in mind. Shopper Insights teams leverage data related to distribution, retailer dynamics, promotional activity, and in-store experiences to influence their business’ sales and marketing efforts where shoppers buy (e.g., in-store or online). Consumer Insights teams typically work more closely with brand health and perception data, consumer preferences, category trends, and other research that can influence their marketing both above and below the line. So how do these differences manifest themselves?

Sales vs. Marketing (Push vs. Pull)

Shopper Insights roles are often (though not always) tied to a company’s sales structure. Analyses for Shopper Insights tend to be retailer and channel focused, building stories for improved distribution, assortment, placement, and promotions based on HOW and WHEN people purchase, and WHAT they buy or don’t buy. The goal of shopper research is typically to establish the category management and sales teams as an expert to drive the store’s retail strategy, answering questions like:

Did the shopper go to several retailers in the shopping trip?

Were they exposed to a circular publication before going into the store?

How often do they buy this product and how much of it do they buy?

What else did they purchase during this trip?

In contrast, Consumer Insights teams are generally more concerned with the attitudes, beliefs, and behaviors that subconsciously influence the purchase decision. Consumer research focuses more on when, why, and how people interact with a brand or category and how the brand is perceived, what emotions it evokes, and the need states it fulfills. Brand teams work with Consumer Insights to create products and messaging that align with these consumer needs. This often includes information on:

Who is their consumer? Demographics, psychographics, lifestyle, values, etc.

When do they use a brand’s product (or similar products?)

How do people feel about a brand and its competitors?

How and when should a brand most effectively/efficiently reach its target?

Core Customers by State

We list out the customers that are prime for your launch efforts (state to state). We also list the important marketing programs that each State Department of Agriculture has. We educate clients about those important targets that are local, regional and national.

Retail Formats

- Supermarkets

- Convenience Stores

- Natural Retailers

- Specialty Retailers

- E-Commerce Platforms

- Club Stores

- Mass Merchandisers

- Drug Stores and Pharmacies

- Military Retail Formats

- Candy Stores

- Office Supply Stores

- Party Stores

- Craft and Hobby

- Truck Stops

- Wine Stores

- Specialty Food Stores

- Sporting Goods Stores

- Hardware Stores

- Farm Supply Stores

- Veterans Canteens

Food Service Formats

- Vending Distributors

- Hospitals

- Colleges and Universities

- Offices and Factories (Micro Markets)

- Rehab Clinics

- VA Hospitals

- Prisons

- Active Aging Centers

- Stadiums and Arenas

- Restaurants

- Hotels and Resorts

- Airports and Airlines

- Coffee Shops

- Smoothie Shops

- Water Parks/Theme Parks

- Zoos and Aquariums

- Schools (k-12)

- Movie Theatres

- Juice Shops

- Fitness Centers

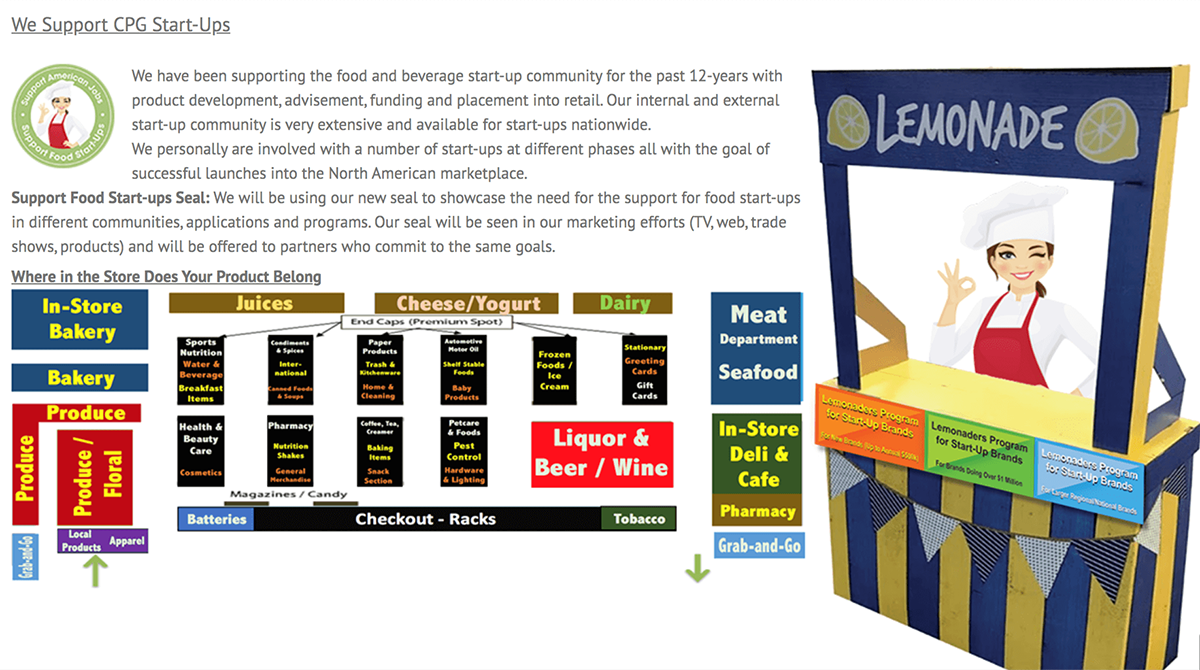

The Lemonaders Group and its partners have mentoring programs available for start-up food and beverage brands needing help with their growth needs. Subjects such as Sales Planning, Product Development, Ethnic Marketing, Business Modeling, Strategic Marketing, Business Plan Writing, Marketing Plan and Proposal Writing, Corporate and Product Branding, Marketing Research, Advertising and Media Planning, Sales Promotion and Special Event Development, Supplier Sourcing and Liaison, New Business Development, Direct Product Sales, Territory Development, Trade Show Marketing, Forecasting, Affiliate Marketing, Racks/POS/Fixtures, Web Development, TV Production, Retail Store Development, Floor Plans, Social Media, Schematics, Category Management and more.

![]()